Kate Phelon, right, executive director of the Greater Westfield Chamber of Commerce, presents a document to Westfield City Council President Brian Sullivan during last night’s public hearing for discussion on the local tax levy pertaining to businesses and homeowners. (Photo by Frederick Gore)

WESTFIELD – The City Council members were urged last night to continue taking a business-friendly stance when adopting a shift factor at the Council’s Dec. 5th meeting.

The Council had continued the public hearing on the shift factor, one of the key elements in setting a tax rate, from its Nov. 7th meeting, to allow businesses and residents to make a case for moving the shift to the advantage of either businesses or residents.

Last night the business community showed up to argue that the city needs to move the tax burden away from business, if for no other reason than to make the city more attractive to bring in new businesses and retain those already here.

The City Council will set the shift factor and 2014 tax levy at its Dec. 5 meeting, but deferred that vote last night because the city’s free cash, projected at about $3 million, has not been certified by the state Department of Revenue.

Free cash is money in the previous fiscal year budget that was not incumbered, and unanticipated revenue in that previous budget year. The DOR has to certify that those funds are not required to balance the previous fiscal year accounts.

Free cash or stabilization funds have been used in recent years to lower the amount of revenue raised through the tax levy. Last year the tax levy was set at 1 1/2 percent instead of the maximum 2 1/2 percent allowed under state law.

The 2013 residential tax rate is $16.72 per $1,000 of property value and the commercial, industrial and personal (CIP) property rate is $31.09 per $1,000 of property value. The 2012 residential rate was $16.13 and the CIP rate was $30.36.

Kate Phelon, executive director of the Greater Westfield Chamber of Commerce, said that the Chamber is requesting the City Council to move the shift from the 2013 number of 1.63 to 1.57 for the 2014 tax levy.

That shift factor divides the total levy between residential property and commercial, industrial and personal property. Residential property accounts for about 80 percent of the total property value in the city.

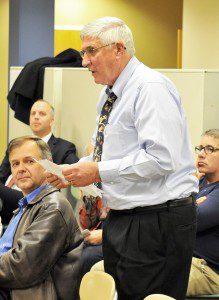

Bill Lawry, of Westfield, voices his concern relative to the determination of the percentages of the Westfield tax rate for businesses and homeowners during a public hearing last night of the Westfield City Council. (Photo by Frederick Gore)

“We understand that this request may not be popular, but it is a fair one,” Phelon said. “When the City Council members discuss the so-called shift, they should also take into account the other property taxes placed on the business owners in addition to the initial calculation.”

Phelon said those other taxes include a much higher stormwater management fee, a Business Improvement District (BID) fee, as well as other fees. Phelon said that businesses also do not receive the same level of municipal services as residents receive, and have to pay additional money for services such as trash disposal.

Phelon said that a residential property and a commercial property with the same assessed value of $400,000 have significantly different tax assessments. The residential property would be taxed at $6,688, while the commercial property would be $12,436.

Atty. Calvin Annino Jr., in written communication to council members, supported the Chamber’s recommendation.

“It seems that a simple review of the disparity between the tax imposed on two identical properties, based solely on one being commercial and the other residential, would compel a discussion on tax fairness,” he said.

Bill Lawry said that he is taxed for both his residential property and his commercial property.

“I do care very much about Westfield and its future,” Lawry said. “Being a residential and industrial property owner, I guess that you could call me a hybrid tax payer.

“I support a flat tax (without a shift) for the city, but I am also a realist and know this will never happen in my lifetime. I also realize that this would be political suicide for the 13 of you,” Lawry said. “What I am asking is that you move this shift more to a balanced ratio, closer to a 1-to-1 ratio. This does not have to happen all at once.”

Lawry said that the Council, in recent years, has been moving the shift toward lowering the commercial tax rates.

“Now is the time to continue that policy,” Lawry said.

Ward 1 Councilor Christopher Keefe said that when he came onto the council in 2003 the shift factor was 1.49, but the residential property value “shot up during the real estate bubble” of the early and mid 2000s “spiking” residential property values.

Keefe said the council pushed the shift up to 1.7 to provide relief for residential property owners who saw significant increases in the assessed value of their homes.

“As the market has stabilized, the council has pulled the shift back,” Keefe said. “We stuck it to businesses for the last 10 years.”

The council will debate the shift factor and its impact on all classes of property at the Dec. 5 session, at which they are anticipated to adopt a shift so tax bills can be sent out before the end of the calendar year.