I’ve been reading the other articles about the taxes and the tax shift. I’d like to thank the Westfield News for allowing the thorough discussions and multiple viewpoints to be shared with the residents of Westfield. This is a very emotional topic for some, and has great financial impacts for many. It’s also quite complicated to explain without spending a huge amount of time and ink.

I’ve been working with these budgets for years, and as you know, I’ve been quite critical of the way the city budgets are prepared, the unsustainable nature of our labor contracts, the mathematically impossible situation we are in with regards to our long-term debts and obligations.

Right now, we are in a one-time position to reduce taxes. Some people have asked me “why if we are in a mathematically impossible situation are you OK with reducing taxes? Shouldn’t we be maxing them out?” My answer is: the reason I am OK with the tax reduction is because last year we received an unexpected one-time bond premium of $3.8 million.

This is money we are getting in this year’s free cash, but that we’ll have to pay back over the next 15-20 years. If we were taking this $3.8 million one-time windfall and paying off debt, or setting it aside to pay future obligations, I’d be fine. But, this mayor doesn’t want to do that. He wants to spend a lot of that money on operating expenses. Given that scenario, I’d rather give the money back to taxpayers. I feel it’s better to give a tax reduction than it is to use one-time money for recurring – in many cases growing – operating expenses.

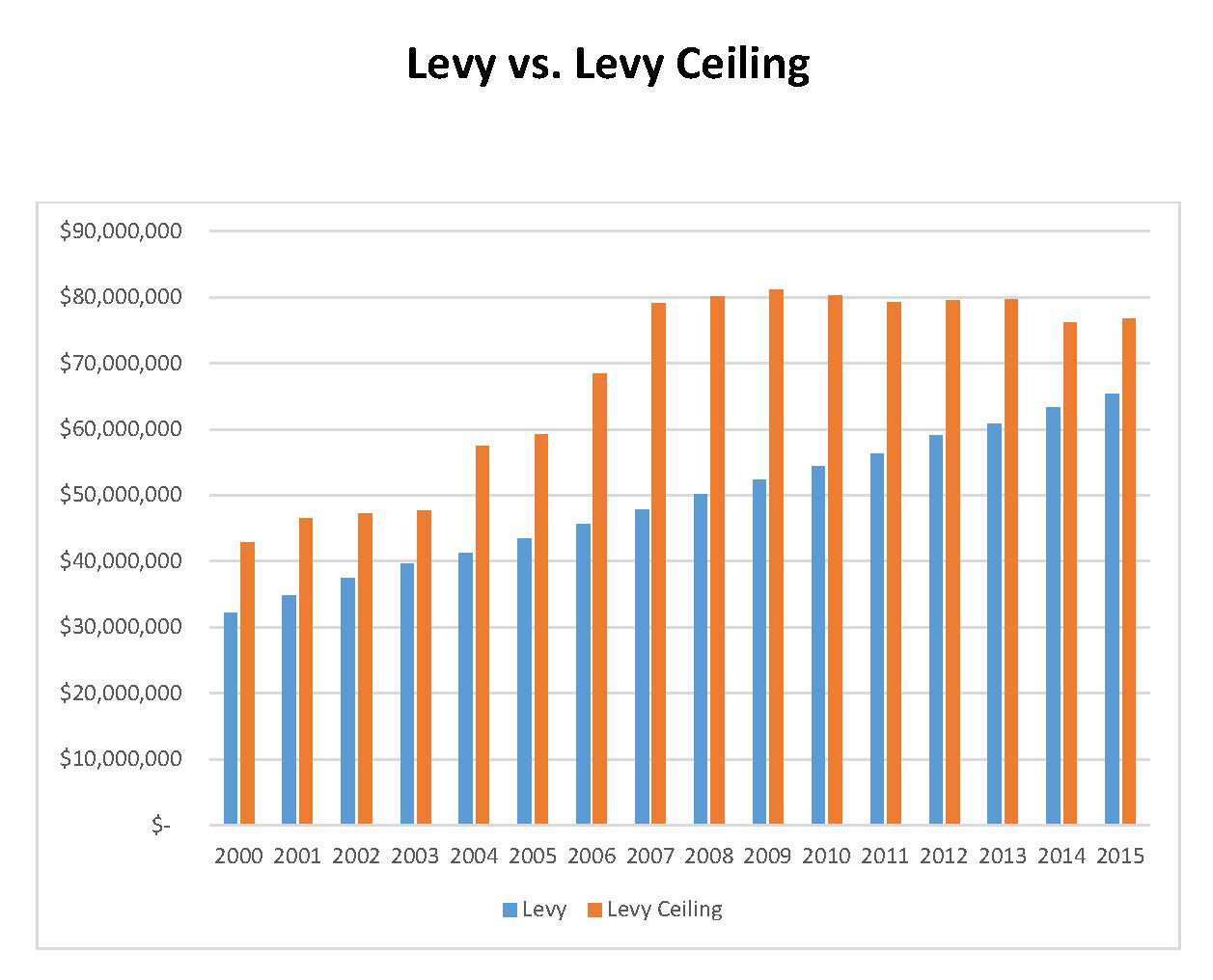

One of the writers in a recent Letter to the Editor claimed I made logic or math errors in a presentation I made before the city council and the public with regard to the Levy Ceiling (this is the maximum we can collect in taxes under Prop 2 ½). I had presented a graph showing the history of the Levy Ceiling and the actual tax levy going back to FY2000. During discussion I mentioned that one of my big concerns given the growth rates in our budgets, and the hundreds of millions of dollars in deferred unfunded obligations, was that we might reach our Levy Ceiling – like Holyoke has. Once we hit that ceiling, we can’t bring in more tax revenue without a vote of the people (which is really really hard to get passed). This is a valid concern, and certainly not a logic or math error as suggested by the writer. The writer suggests that if we change the timeframe all the way back to 1985 that we’d get a different picture. The reason I went back to FY2000 was that was the timespan I used on other graphs in my presentation. However, now that he’s brought it up, I think anyone would understand that the boom times of Reagan, Bush, and Clinton, and the irrational exuberance period when anyone with a pulse could get a mortgage with generous terms, are not likely to repeat anytime soon.

The economy has stalled a bit over the last several years (saying it nicely). I think we are likely to see an improvement in the coming years (fingers-crossed), but I don’t think anyone truly expects the economy or real estate market to grow like it did back in the 80s and 90s. The Fed has used low interest rates to support the economy. They really can’t go much lower, and if they increase, that will tend to put downward pressure on real estate prices – not the upward movement we need to avoid hitting the levy ceiling. The other scenario is inflation. This would increase the property values, but it would also increase just about every other expense as well, so our relative position wouldn’t really improve – and certainly wouldn’t improve enough to take care of the “mathematically impossible” long-term obligations.

This same writer is harping that Councilor Keefe is misleading the public by saying that the tax increase proposed by the mayor isn’t the 1.25 percent that he’s claiming, but is really about 1.77 percent. I agree with Councilor Keefe. We’ve been through this many time times. The mayor claims a low percent, but the reality is higher (he also does that repeatedly with labor contracts). In this case, Councilor Keefe Is right to say that the mayors proposed levy is going up by well over 1.25 percent – just look at the numbers.

I know that a few people question why the council is holding up a vote on the tax shift. The mayor and his team are piling on the pressure to incite the public to force the city council to do what he wants. I’m proud of Chairman Keefe’s action that was supported unanimously by the City Council. The reason we are holding-up the vote on the shift is that we want to make sure we know what the levy will be before we vote on how to share the tax burden. We don’t know that right now. We have been presented with two different numbers for the levy, and we have $12.5 million in the bank – some of which the city council would like to use to reduce the tax burden (levy). The mayor has not been flexible, and in fact has been downright dismissive to the opinions of several of the leading, long-standing, members of the city council.

This needs to change. We’re all looking out for the best interests of the citizens, and we are two separate but equal branches of government. He needs to understand that.

I’d be happy to answer any questions or share any data that I have related to these matters. Please feel free to contact me by email at any time.

Regards,

Dave Flaherty

City Councilor

[email protected]