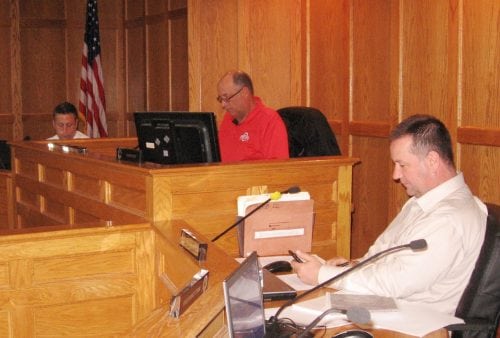

L&O Committee: Councilors Nicholas J. Morganelli, Jr., Ralph Figy, chair, William Onyski.

WESTFIELD – The Legislative & Ordinance Committee chaired by Ward 2 Councilor Ralph J. Figy met on Tuesday in Council chambers, acting on several motions that have been in committee for some time.

The first was a motion originally made by At-large Councilor Brent B. Bean, II and former Councilor Stephen Dondley from August of 2017, to increase property tax deferments for residents 65 and older by phasing in higher income eligibility for the program. Currently, the income eligibility level is $20,000 per household.

Figy explained that the law is basically a tax deferral system at 8% interest that allows residents to defer paying taxes until a house is sold. “We can increase the minimum from $20,000 to $30,000,” Figy said, adding that the treasurer and assessor explained at their last meeting that not a lot of residents are currently eligible, and there are only three taking advantage of the program.

Figy said he also believes the 8% interest rate is one of the factors, and he would also like to see the interest rate decreased to 6%. Figy said the program is important for his ward, which has a large population of senior citizens on fixed incomes.

L&O member William Onyski agreed to Figy’s plan, although he said the committee was guessing on the changes in numbers. “We have to start somewhere. If it looks like (participation) might be increased, we might consider increasing the income level,” he said. The income eligibility may be increased to a maximum of $56,000 per household. “We’ll never know until we put it out there for a year or two,” he said.

“I think it’s a good idea, to give it a shot,” said L&O member Nicholas J. Morganelli, Jr.

Figy added that the program is totally voluntary and totally residential. He said it acts as a savings account for the city, which won’t get the payments as long as the homeowners are still residing in their home. “I don’t think it will be big,” Figy added.

At-large Council Daniel Allie asked the committee whether the homeowner would have the right to pay part of their taxes, and whether the city would have the first portion on the deed.

Shanna Reed, First Assistant City Solicitor, said the Department of Revenue allows eligible residents to defer all or part of the balance of taxes owed. Figy said the city would have the first portion.

The motion to increase the income eligibility to $30,000 and decrease the interest from 8% to 6% passed 3-0. Attorney Reed said that in bringing it out to the full Council, the committee will need a resolution, which she offered to word.

OPEN BURNING

A motion by Councilor Morganelli on behalf of the Public, Health and Safety Committee to amend the city ordinance on open burning had a “long and winding road,” said Figy. He invited Allie to the microphone to give the history of the motion, which Figy said was actually started by former Ward 3 Councilor Brian Hoose, in an attempt to allow charcoal grills in a park.

“This is a case of writing a clear purpose of what you want,” Allie said. He said currently, fire pits are considered open burning unless used for cooking.

He said the Public, Health and Safety Committee worked on an ordinance with Attorney Meghan Bristol that they sent to the Mass. Department of Environmental Protection (DEP) for tacit approval; taking all of last summer. Allie said the ordinance hasn’t changed much since then, except to delete the line that it would be subject to any future state and federal laws.

Allie said that one of the major objectives of doing all this was the prohibitive Mass DEP fines, which starts at $1,000 for a first offense, $5,000 for a second, and $10,000 for subsequent offenses. The new ordinance lowers the fines to $50, $100 and $150. He said they also put in provisions to protect people, safety, and public nuisance, including a requirement that pits be 20 feet from a structure, twice the manufacturers’ recommendations.

Allie said they had to walk the fine line of not writing something that would trip them up with the state. “To me, fire pits are not open burning,” he said.

“I know that was an issue of concern for Attorney Bristol, if we chose to leave it out,” Figy said, adding that the city is still subject to state and federal laws, “so it’s ok to leave out.”

Figy added that when the ordinance first started through the City Council, residents thought the Council was trying to outlaw open burning. “It couldn’t be further from the truth,” he said.

Ward 1 Councilor Mary Ann Babinski asked if the Westfield Fire Department had gotten a last look at the ordinance. Allie responded that the concern of the Fire Department is always looking for the safest thing, but their recommendations, such as 50 to 75 feet from structures, would have ended up banning it. He did say however that the ordinance hadn’t changed since the last time the Fire Department saw it.

Reed said that when it does come out of committee, there has to be a public hearing that is advertised for two weeks; part of the MassDEP requirements. A motion was made to bring it out of committee and set up a public hearing.

CARBON CREDITS

Also recommended by a vote of the committee was a resolution approving an Intermunicipal agreement implementing a carbon credit consulting services agreement between the cities of Westfield, West Springfield and Holyoke.

Reed said that City Solicitor Susan C. Phillips had done a lot of work on the agreement, which started with a request for proposal (RFP) from West Springfield, looking for other cities as joinders for a purchaser (Blue Source) of carbon credits. She said in the hypothetical annual carbon credit accounting, Westfield could earn $70,000 “for something we’re already doing.”

Onyski asked what would be the obligation of the city to keep land wooded. Reed said that the agreement is for specific areas that are already conservation restricted, so there would be no obligation to do any more than the city is already doing.

Morganelli asked where the money comes from, and how the company makes money. Reed said it was a complex analytical way of selling credits, and the company makes their money through a cut of the credit. She said the three towns combined forces to get a company to respond to the RFP, because no one city had enough on its own. She said it’s a ten-year contract that the City Council has to approve because it’s for more than three years, and it’s an intermunicipal agreement. The motion was recommended, 3-0.

The only motion to receive a negative recommendation was one originally by At-large Councilor Dave Flaherty from February to eliminate the automatic acceptance of a job description if the City Council does not act within two meetings.

Reed said in the code of ordinances, job descriptions of heads of departments are reviewed by the Personnel Action Committee, after which the City Council has two meetings to vote them up or down. If not rejected by the City Council at the second meeting, the job description goes into full force and effect.

Figy said that in his recollection, the ordinance had only taken effect twice. The first, when he was a new councilor and chair of the Personnel Action Committee, and left a job description in the committee for six months, unaware of the two-meeting regulation. He said the second time was last year, when the job description for the position of Chief Financial Officer was sent to the Personnel Action Committee and to another sub-committee that didn’t meet, and it timed out.

Figy said the ordinance, which was written in 1997, keeps committees from holding up hiring. “Personally, I would leave it alone,” he said, adding that it is important for councilors to know that they cannot modify a job description, just vote it up or down. “As a council, we have the right to approve it or send it back,” he said.

Figy also said the last four years, the Personnel Action Committee chaired by At-large Councilor Cindy Harris “has been most efficient.” The motion for a negative recommendation passed 3-0.