Next week, the city council is expected to vote on Mayor Sullivan’s proposal on what to do with the money in the so-called “free cash” account. This account holds the money left over from previous fiscal years that was not spent. The free cash account should not be confused with the stabilization account, sometimes also referred to as a “rainy day” fund, which the city generally uses to weather bad financial times or help fund capital and emergency projects. Money in the free cash account requires a simple majority of councilors to spend while stabilization money requires a super majority, usually 9 votes, to spend.

The mayor’s proposal would take approximately 1/3 of our free cash, $3.5 million, and place it into the stabilization account. Another 1/3 would remain in the free cash account. The final 1/3 would be applied to this year’s budgeted items which would help keep the property tax rate a bit lower.

The city council can only take an up or down vote on the mayor’s proposal. If the council rejects his proposal, the money in free cash cannot be spent and so the money to cover this year’s budget will need to be raised through property taxes.

Some city councilor’s are calling for more free cash be used in order to achieve a 0% property tax increase. Unfortunately, this would be a very reckless move.

One reason cited by those gunning to spend more free cash is the claim that Westfield is in danger of reaching the levy ceiling. The levy ceiling represents 2.5% of a community’s cash value of their properties. The current value of all of our properties is a bit over $3 billion, which places our levy ceiling at about $78 million (2.5% of $3 billion+). The city is barred by law, set by Proposition 2 1/2 many years ago, from raising more than this $78 million figure with property taxes.

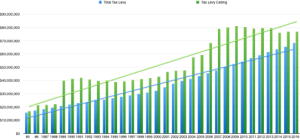

One councilor is arguing that we should not raise property taxes this year so that we can remain a safe distance from the levy ceiling. First of all, we have been very close to the levy ceiling in the past, such as in 2003. What happened then, however, is that property valuations increased which lifted our levy ceiling much higher (please refer to bar graph accompanying this article). As we move further out of the recession, it’s very possible that property values will rise again and all the present hand wringing over the levy ceiling would be over nothing.

One councilor is arguing that we should not raise property taxes this year so that we can remain a safe distance from the levy ceiling. First of all, we have been very close to the levy ceiling in the past, such as in 2003. What happened then, however, is that property valuations increased which lifted our levy ceiling much higher (please refer to bar graph accompanying this article). As we move further out of the recession, it’s very possible that property values will rise again and all the present hand wringing over the levy ceiling would be over nothing.

Secondly, the long-term trends since 1985 show that the levy ceiling figure has been growing faster the total tax levy figure. If you refer to the chart, you’ll see the green line, representing the levy ceiling, outpaces the blue line, representing the tax levy. It’s best to use all available data and long-term trends, not just cherry pick the last few years to suit your argument.

For example, I could cherry pick the data and say that we only grew .5% closer to the levy ceiling this fiscal year compared to last and argue that would give us about 21 years before hitting the levy ceiling (we are currently at 89.4% of the levy ceiling. But that would be dishonest. The simple fact of the matter is that we don’t know when or even if we will hit the levy ceiling. Anyone claiming we have three years left before we hit the levy ceiling is simply being an alarmist. But, as the motto goes, we should hope for the best but prepare for the worst.

And that brings me to my final point. Municipal finance experts will tell you that the proper thing to do when approaching the levy ceiling is to stash as much money away into our savings accounts as much as possible before you hit the ceiling so you have money in the bank to keep the city running. Using free cash funds to fund our budget, as suggested by some city councilors, is absolutely the wrong and irresponsible route to take.

But don’t take my word for it. Ask our auditor, Thomas Scanlon. When Pittsfield approached the levy ceiling, Scanlon was quoted in the papers, stating:

“In recent years, [Pittsfield] has been using that to offset tax increases, which essentially is funding operations. Scanlon said the ‘non-reoccurring’ funds should not be used to fund operations but instead should be there for one-time expenses such as capital items.”

So when it comes to a vote next week, I will not be siding with other city councilors who are making very bad arguments for spending free cash on operating expenses. Instead, I will be taking a more fiscally responsible approach and listen to the advice of experts like out auditor, Thomas Scanlon, who deal with municipal finances for a living.

Before I close, I just want to say how amazing it has been to meet and see all the wonderful events and activities the hundreds of involved citizens across the city are working on. Westfield is going through a mini-Renaissance in arts, culture, and volunteerism that is breathing new life into our city. It’s been fantastic to meet so many wonderful people who care so much about our city to give their time and talents to our community. Thank you to all!

With that, I want to wish all my fellow Westfield citizens a very Merry Christmas and the happiest of holidays. See you in 2017!