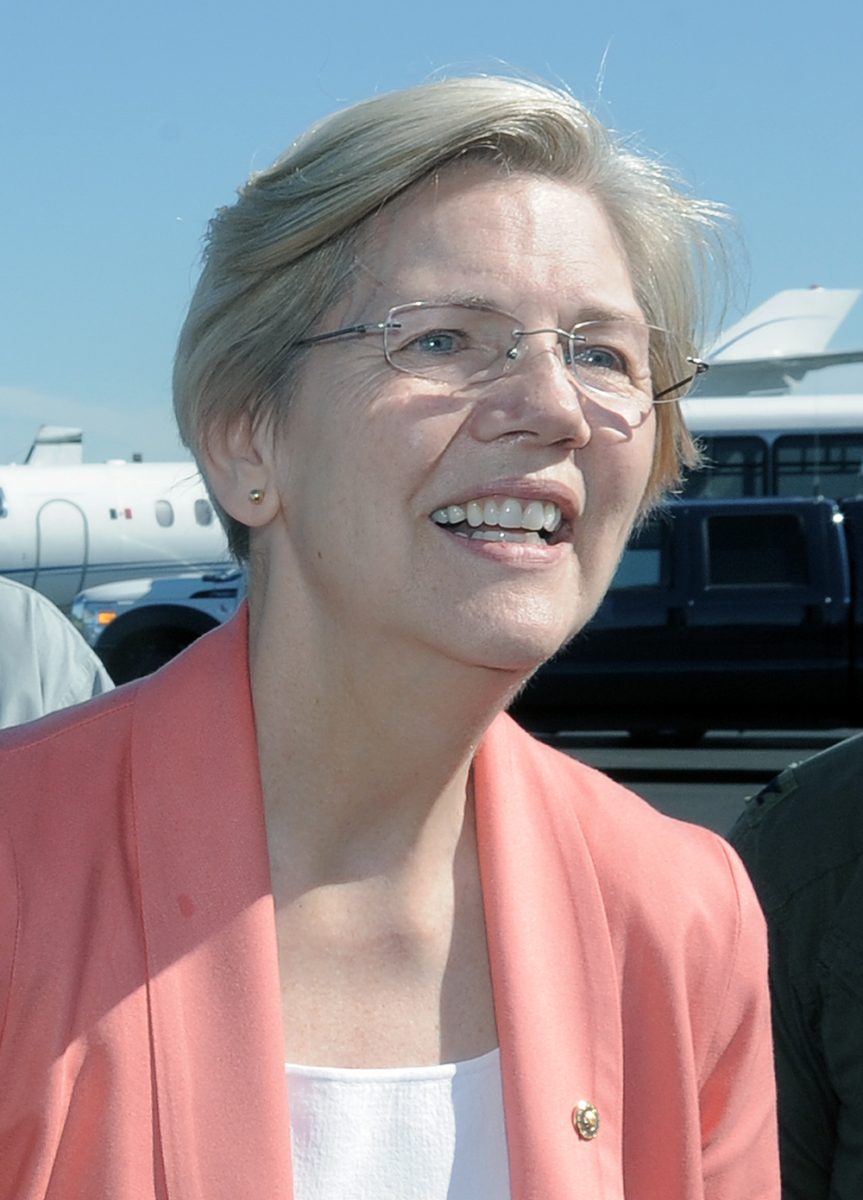

STEVE LeBLANC, Associated Press

BOSTON (AP) — A bill sponsored by U.S. Sen. Elizabeth Warren that aims to give the public more details about settlements reached by federal enforcement agencies has passed the Senate.

The Massachusetts Democrat says the goal of the bill is to require the agencies to be more transparent about any deals cut as part of the agreements.

She said when the government settles cases, it highlights the dollar amount obtained from the offender but often doesn’t point out tax deductions and other credits built into the settlement that can reduce its actual value.

“The idea behind this bill is straightforward: If the government is going to cut deals on behalf of the American people, the American people are entitled to know what kind of a deal they’re getting,” Warren said in a statement Tuesday.

The bill, which passed the Senate by unanimous consent Monday evening, covers any settlement between the federal government and a private party where the private party pays a million dollars or more. The bill now heads to the U.S. House.

Federal agencies would be required to post basic information about major settlements online and provide copies of those agreements on their websites, according to Warren.

Any written public statement that an agency issues about the value of a major settlement would be required to include an explanation of how those settlement payments are categorized for tax purposes and whether payments may be offset by credits for particular conduct.

The bill would also:

— require agencies to explain publicly why confidentiality is justified in any particular instance;

— direct agencies to disclose basic information about the number of settlements they deem confidential each year;

— instruct the Government Accountability Office to conduct a study of confidentiality procedures and to provide additional recommendations for increasing transparency.

Warren pointed to a 2013 settlement with 13 mortgage servicers accused of illegal foreclosure practices. She said federal regulators claimed the settlement totaled $8.5 billion, but more than half of the settlement value — about $5.2 billion — was in the form of credits the servicers could get for agreeing to modify or forgive loans.

Warren said the public statement didn’t explain that the servicers could claim an entire credit by forgiving a portion of large unpaid loans. For example, she said, a servicer that wrote down $15,000 of a $500,000 unpaid loan balance would get a credit for $500,000, not $15,000.

She said the undisclosed method of calculating credits could end up cutting the overall value of the $8.5 billion settlement by almost 60 percent.

The legislation was co-sponsored by Oklahoma Republican Sen. James Lankford.