SPRINGFIELD – Massachusetts may see rising home sales soon.

SPRINGFIELD – Massachusetts may see rising home sales soon.

Western New England University’s Rivers Memorial Hall Thursday played host to the Real Estate and Economic Forecast event, put on by the Realtor Association of Pioneer Valley and the Home Builders Association of Western Mass.

The event featured presentations from leading economists, including Dr. Lawrence Yun, Ph.D, chief economist and senior vice president of research for the National Association of Realtors.

“Boston has been hot, but when one looks at the weaker spots, the broad New England area outside Boston… has seen sluggish recovery,” said Yun, who added that greater Springfield has been up and down as the region recovers from the Great Recession.

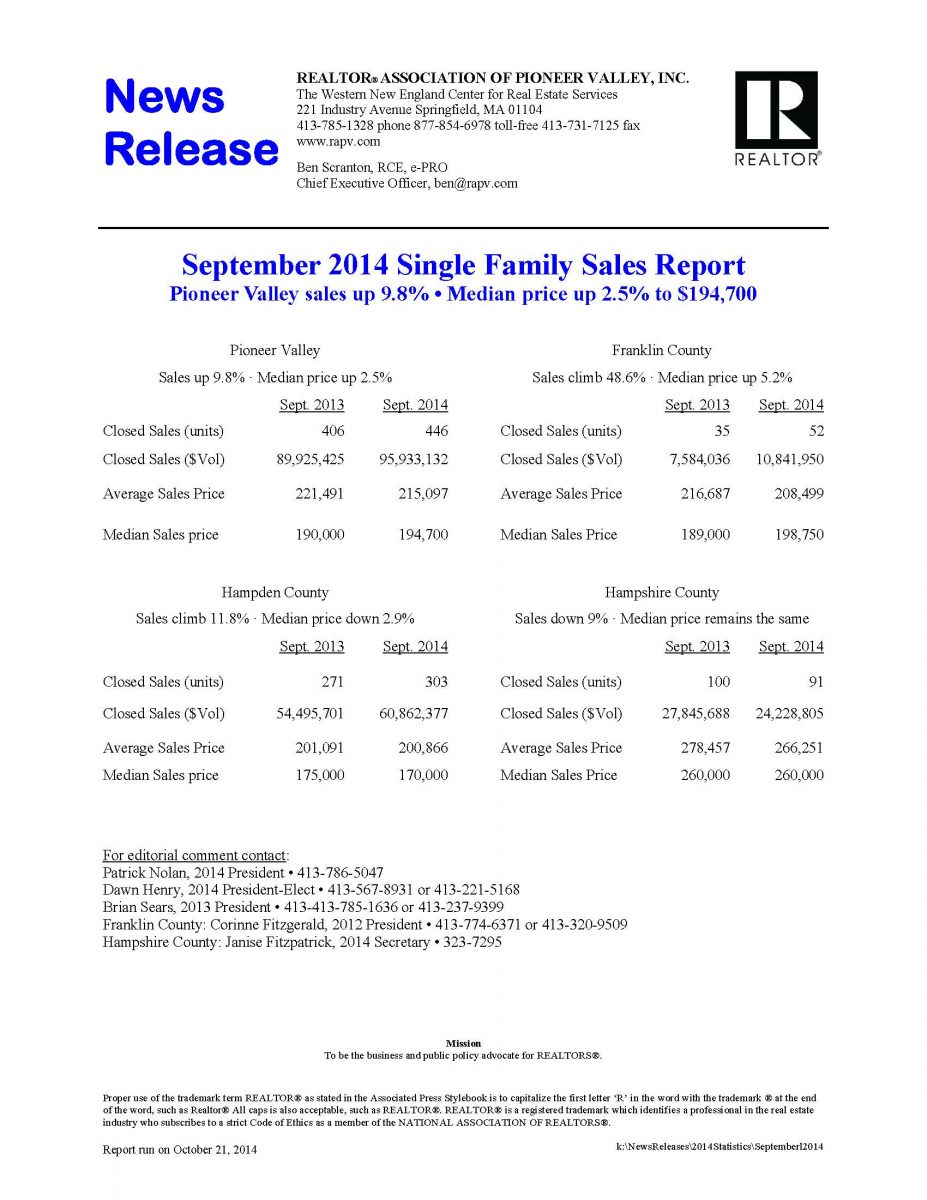

“One month, very positive and the next month, what happened?” he asked. “September data that came out very recently was very good. Sales were up 10 percent from the year before, so Springfield is doing better than the national trend.”

“It looks like September was good, but what’s going to happen in October?” asked Yun, who presented a slide listing data for the Pioneer Valley showing home sales were also up 8.1 percent in August, while the median price was down 1.2 percent and the dollar volume was up about 7 percent.

Yun also stated that population increases seen in the United States over the last 14 years have seen a huge increase in rentors, which he said will lead to “pent-up demand.”

“In 2013, after two years of housing recovery, how many homes are we selling (nationally)? Five million – essentially the same as in 2000,” said Yun. “What about the population? 34 million additional people are now living in the country (since 2000). So why are we selling the same number of homes?”

“People are becoming rentors or living in the basement,” he said. “So the underperformance of housing means a potential pent-up demand as long as the economy keeps expanding and creates jobs and credit is accessible.”

Unlike metro Boston where housing stock is relatively limited, western Massachusetts – the Pioneer Valley, specifically – has a considerable amount of housing inventory and “shadow inventory” – homes where owners are failing to pay their mortgages.

“There will be additional inventory coming from the shadow inventory in Massachusetts, particularly in areas where home prices haven’t risen as much,” said Yun. “In Boston, shadow inventory is declining much faster because prices have risen, but in Springfield it has not.”

“So if you specialize in foreclosures, there’s still business coming your way,” he said.

Yun said that he doesn’t expect another recession to occur but warned to watch out for inflation in 2015.

“I think the summary is that, all the fundamentals suggest increased sales activity,” he said. “All the factors for rising home sales are occurring. The only thing that isn’t occurring is rising home sales. This year could be a temporary pause, but with credit opening up, job creation and pent-up demand, I hope my forecast pans out.”

“I found Dr. Yun’s overview of ‘multi-year economic recovery’ interesting as he addressed the importance of job creation, manageable mortgage rates and more inventory,” said Heather Witalisz-Siegel of Westfield’s Witalisz & Associates, Inc.

A Managing Partner and Realtor at the boutique real estate firm, which specializes in “helping buyers and sellers navigate the real estate transaction process”, Witalisz-Siegel cited several listing sources when referencing Westfield’s housing economy so far this year.

“Comparing the first three quarters of this past year in Westfield to that of 2013, we have found that the median price of single family homes has increased slightly by almost four percent,” said Witalisz-Siegel. “This may be attributed to a small bump in the number of homes sold in the $350,000-$400,000 price range. With the average time on market for these single families at about eight days longer compared to last year, we are seeing a slight improvement and anticipate the same over the next four to five years.”

“Understanding we are settling in for an economic recovery, we anticipate it to seem choppy at times.” she said. “That being said, buyer activity has been consistent and healthier recently than years past and sellers are learning to be more realistic in their property values.”