BOSTON – Treasurer Deborah B. Goldberg last week proposed a series of reforms to the Pension Reserves Investment Management (PRIM) Board’s custom proxy voting guidelines, targeting board diversity, wage equality, renewable energy, human rights standards and other issues aimed to strengthen corporate governance and protect the value of the pension fund’s investments.

“Demanding that companies create diverse leadership teams and confront the threat of climate change are no longer simply admirable social goals,” said Goldberg. “These reforms will help protect the stability and financial success of the companies that we invest in.”

In line with her commitment to enhance diversity, both in government and in the private sector, Goldberg proposed a new policy to vote against all board nominees if less than 25 percent of the board is diverse in race and gender.

The Treasurer announced several additional changes to the PRIM custom proxy voting policy, including voting for proposals that:

Seek increased investment in renewable energy sources.

· Request a report on company energy efficiency policies and goals.

· Ask companies to stop all misleading advertising to youth and to increase health warnings on cigarette smoking.

· Ask companies to increase recycling efforts or adopt a formal recycling policy.

· Call for linkage of executive pay to non-financial factors, including performance related to social and environmental goals, customer and employee satisfaction, corporate downsizing, community involvement, human rights or predatory lending.

· Implement human rights standards and workplace codes of conduct.

· Request that a company conduct an assessment of the human rights risks in its operations or in its supply chain.

In addition to the proposals above, the Treasurer also introduced a new statement of principle in which PRIM calls on companies to lead on the issue of wage equality and proactively seek to hire a diverse workforce.

“Large institutional investors such as PRIM have the ability to influence corporate governance and policy through the proxy voting process, and PRIM has traditionally exercised that influence based on guidelines established by the PRIM Board,” said Michael G. Trotsky, CFA, executive director and Chief Investment Officer of PRIM. “Treasurer Goldberg has placed a priority on examining these guidelines and considering changes and areas of expansion. I applaud her efforts.”

“Treasurer Goldberg’s initiative will help protect the assets of Massachusetts’ retirees over the long term,” said Mindy Lubber, president of the nonprofit sustainability advocacy group Ceres, which directs the $12 trillion Investor Network on Climate Risk (INCR). “Climate change, wasteful use of natural resources and human right issues can significantly affect the value of companies, and these proposals will encourage companies to better manage these risks and embrace solutions such as energy efficiency, renewable energy and human rights protections.”

“The research is irrefutable. Companies with diversity on their boards, and especially the presence of women, are more profitable and more sustainable,” said Malli Gero, president and co-founder of 2020 Women on Boards. “The new guidelines will bring Massachusetts to the forefront of diversity initiatives in the US. We applaud Treasurer Goldberg’s attention to the issue.”

“The Treasurer is taking bold and fresh steps in the right direction to enhance diversity on corporate boards, as it should be,” said Darnell L. Williams, president and CEO of the Urban League of Eastern Massachusetts.

“Treasurer Goldberg’s leadership is important,” said George Bachrach, president of the Environmental League of Massachusetts. “Money talks and where we invest public funds makes a difference. Encouraging companies to increase their energy efficiency and clean energy can also increase their bottom line and ours. This is good for both the Commonwealth’s investments and environment.”

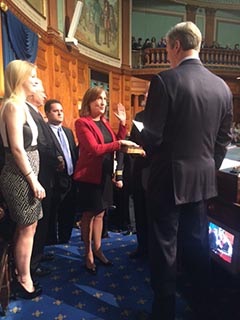

Goldberg led a review of the custom voting guidelines shortly after taking office and worked closely with PRIM staff before presenting the recommendations to the Audit and Administration Committee today. If approved by the Committee, the new policy will then be presented to the PRIM Board, the nine-member board that oversees the state’s $61 billion pension fund, at its April 7 meeting.