Happy Birthday Westfield! Let me start by congratulating everyone who was involved in the Westfield 350 Celebration activities. What an awesome job! You should all be very proud.

Happy Birthday Westfield! Let me start by congratulating everyone who was involved in the Westfield 350 Celebration activities. What an awesome job! You should all be very proud.

Let me also congratulate the recent, and soon to be, College and High School students. I wish you the best as you take that next step in life.

Before I get into my budget discussion, I want to talk about some of the negative feedback, social media nonsense, and personal attacks that I and others have received in the last year or so. The level of misinformation and negativity is getting ridiculous. There are many people who are choosing not to get involved in local politics because they don’t want to put up with the social media nonsense. How does that help the city? Smart, talented, hard-working people, who would be willing to serve, but instead are saying “no thank you – why would I want to deal with that nonsense”.

Let’s start with “who’s responsible for what”? The City Council has been blamed for things that are clearly not within our scope of responsibilities. Westfield’s form of government has the Mayor as Chief Executive, and dozens of boards and commissions that run, or are responsible, for various departments.

All of these boards and commissions meet regularly and take input from the public. All of the board and commission members are listed on the City website. Problems with water? You need to see the Water Commission, Water Department, and DEP. Problems with schools? You need to see the Principals, Superintendent, or School Committee. Problems with Fire or Police? You need to see the Fire or Police Commission. Problems with road repairs? You need to ask the Mayor to allocate more money, or the DPW to take care of specific issues.

Problem with taxes? You need to SHOW UP and demand that budget increases be reduced or that money be used in a different manner. You need to talk with the Mayor or City Councilors. You need to contact your state reps to make sure that the state budget delivers the promised state aid. Now is the time. The budget will get approved before June 30th. Don’t wait until after it’s done to complain.

There seems to be some confusion on a regular basis about how the City Council can fix the roads. Some people believe that we can just take money from another department or budget line item and move it to the road repair budget. It doesn’t work that way. The way it works, BY LAW, is that the mayor proposes spending, and then the City Council can approve, deny, or reduce specific line items. City Council cannot increase line items. There are several City Councilors who want more money spent on roads, and for roads to be made a priority in the budget. Though we WANT this, we can’t get make it happen without an appropriation request from the Mayor.

The Mayor has to initiate spending. It’s that simple. However, nothing is simple in our current financial situation. The Mayor clearly understands the will of the people, and the demands for many city services – including roads. Frankly, we don’t have enough money. The Mayor faces great challenges every year just to come up with a budget. The pressures are truly great, and the money situation is very stressful.

For the last several years, the city has budgeted more than it’s collected in taxes, fees, and state aid. The city has used one-time draws from savings to pay recurring growing operating expenses. The city has deferred payment for retiree benefits for decades. This isn’t a sign of incompetence or scandalous behavior, it’s what the Mayor has to do given the financial situation. It stinks. These actions have to be taken because it’s nearly impossible to cut labor and benefits costs. The unions are rather strong in Massachusetts, and the residents and business owners would complain (egged on by the unions) if cuts were proposed to Schools, Fire, Police, or DPW. You can’t even discuss enhancing job scopes, crosstraining, or sharing between other cities and towns without getting huge pushback. Eventually, we’re

going to hit a breaking point. Then things will change.

Some of you are thinking a new Mayor and City Council will change things. I’d say maybe. The new Mayor and City Council is going to inherit newly signed three-year labor contracts. The new Mayor and City Council cannot change them.

Unfortunately, I think we’re going to hit the breaking point before we can make significant changes. That breaking point is about two years away at the current pace.

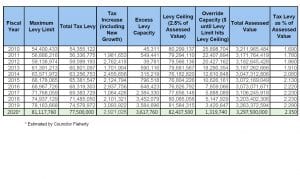

For the last several years I’ve been warning about hitting the “Levy Ceiling”. The “Levy Ceiling” is the maximum the city can collect in property taxes. Under Prop 2 ½, that ceiling equals 2.5% of the Total Assessed Value of all properties in the city. If you look at the chart below, you’ll see that Total Assessed Value has been around $3.2 billion for the last ten years. It’s very flat. Even with new development of all those highly promoted commercial developments, and new residential development or improvements, the Total Assessed Values have remained pretty flat. That means our Levy Ceiling has remained rather flat. Meanwhile, our actual taxes keep going up and up (as you can see on the chart). My estimate (in green on the chart) is that after this year, we’ll be about $5 million away from hitting the Ceiling. That’s about 2 years if we continue on the track we’re on, and if property values don’t increase significantly.

In 2017, I made a big stink about this, and many of you hopefully remember that we made some dramatic one time budget decisions that resulted in a ZERO tax increase (on the chart, you’ll see $1.06 million in new taxes for that year, but that is all from new development). You should also notice the impact that maneuver had on the Excess Levy Capacity column. You’ll see that we now have about $3.5 million of wiggle room. That essentially gave us a bit more than a year more time until we hit the ceiling.

Some people assume we can just vote for an override, and further that the majority of voters would support it. That is not correct. It’s not allowed when the Levy Limit is at the Levy Ceiling. An override only allows a city to exceed the Levy Limit – not the Levy Ceiling. The only way to exceed the ceiling is for a ballot measure that approves a Debt Exclusion for a very particular purpose – for example, a new school. If you want to learn more about this complicated Prop 2 ½ law, please Google search for “Prop 2 ½ Levy Primer”. You’ll find a very well written explanation.

So, what are the consequences of hitting the Levy Ceiling? Basically, the city cannot bring in new Property Tax revenue beyond 2.5% of the increase in Total Assessed Value. You can see from the chart that we’ve been dependent on new tax revenues in the $2.5 – $3.0 million per year range. That money is used to pay for increased costs of employees, benefits, pensions, increases in operating expenses, debt payments, etc… If we don’t have that additional tax revenue, we’ll have to make painful cuts, and yet certain expenses will still grow. For example, we are obligated to pay the pension plan 5.8% more each year. That’s over a half million in increases every year in just that one line item. Where’s the money going to come from? Want another $3 million in road work every year? Where’s the money? Want employees to get cost of living increases plus steps? Where’s the money? Expect the city to be able to pay higher costs for healthcare or retiree healthcare? Where’s the money? Expect to build a new school or public safety complex? Where’s the money?

I know some of you are thinking MARIJUANA!!! That might help with a fraction of an annual baseline increase. Maybe that gives us another half-year before hitting the ceiling?

Another thing to consider is that if property values decline, so will the Levy Ceiling. That means we’ll take in less property tax revenue that we are now. Think about those consequences. What if the city had 5% less to spend on short notice? That’s a real possibility given the values or property and the chaotic world we live in today.

Some say, “Won’t new commercial development help?” The short answer in “no”. The Levy Ceiling only moves up at 2.5% of the increase in values – no matter if the property is taxed at the commercial or residential rate. So, it will take $40 million of NEW development to bring in $1 million in new property taxes. When was the last time you saw $40 million worth of new commercial construction in Westfield?

If you want $3 million in new money, like the city has been accustomed to getting, you’d need $120 million in new development.

Some employee groups think that their long-term health benefits are guaranteed and that the city will find a way to pay the $230+ million net present value that is “owed” to employees. I don’t see how this is mathematically possible given the size of the obligation, the budget, and the constraints of Prop 2 ½.

To give you an idea of the size of the problem, the city should be putting between $9 and $15 million per years into reserves to pay for the future health care obligations (depending on assumptions about costs of plans in future years, number of qualified employees, benefit levels, and returns on investment). It hasn’t done that. I think the recent budget set aside a whopping $20,000. It’s likely in the near-term that employee healthcare benefit programs will have to change.

How to we solve this and/or slow down a collision with the Levy Ceiling? First, control spending

increases. Second, make sure to tax property at full values, and collect all appropriate local fees and taxes. Third, find ways to encourage responsible new development. Forth, pursue every nickel that we can get in state and federal funding, and be very aggressive when pursuing unfunded mandates. Fifth, ensure the Payment in Lieu of Taxes agreements are maximized and that appropriate city overhead is charged to special funds such as Ambulance, Water & Sewer, Stormwater, etc.. And, finally, preserve Stabilization and Free Cash reserve accounts to give us a buffer that can be used for emergencies when we have no other options.

Back to this budget year. There have been reports about the School budget increasing by 3.1% but that it won’t cost the city budget more money. Technically I guess that is accurate. Governor Baker, the

House, and Senate seem to be willing to give all cities and towns a bump up in state aid to schools (Chapter 70). It’s about time!

What bothers me a bit is that for the last couple of years the School budget has grown faster than other parts of the budget, and we’ve taken money away from other priorities such as roads, Fire, Police, DPW, benefits, and IT in order to cover the schools. Another school has been closed, about 38 staff positions will be eliminated, and the unions believe they’d made “significant financial concessions”. You’d think that the budget would decrease – not increase 3.1%! Further, from what I understand, that 3.1% increase was before any labor contract increases. Our student population is down over 750 students since I started on the City Council. School staff has decreased. Schools have closed. Yet, we’re spending over $10 million more per year. The School Committee has to find ways to operated more efficiently, and has to work with other communities to aggressively pursue state aid for schools, special education, ESL, transportation, and special burdens assumed by gateway communities like Westfield.

Another recent article touts “Mayor to Submit Balanced Budget”. Technically, yes. But, that’s the law. It’s no surprise. He’s counting it as balanced even though expenses exceed revenues, and we’re deferring all of those long-term healthcare obligations. In order to get to a “balanced” position, he’s going to have to increase taxes and fees, not make the appropriate investments in long-term obligations, AND probably use some savings (Free Cash or Stabilization). Once again, using one-time money for recurring growing operating expenses. I’m not sure you would consider your personal finances balanced if you deferred paying things, and you relied on lottery winnings or short-term debt to pay your regular bills.

I haven’t seen the budget yet, but I know the Mayor and his team are working hard on it. As I said above, this isn’t an easy task. I know that. Even though I’ve made some strong statements above, I think Mayor Sullivan has done a fine job in many ways. Of course I don’t agree with everything, but nobody agrees with me 100% of the time either. I understand his challenges. The new mayor, whomever that may be, will not have an easy job. There are no easy answers. Since we are in the budget season, and we know Mayor Sullivan is retiring, I’d love to see the Mayoral candidates speak out about this year’s labor contracts and budget. After all, they are going the inherit them. I hope they come to the upcoming budget meetings and speak about what they would like to see. Maybe they can write some articles about how they would do things. Do they support the rumored 5+% labor contract increases? How do they envision solving some of our long-term financial problems? How do they think we can avoid hitting the Levy Ceiling? If we hit the Levy Ceiling, what do they see as the consequences? How will they adjust City spending priorities? How will they fix the roads, buildings, and other infrastructure? What will they do to attract new development? How will they weigh new development against preserving our natural resources and rural sections of town?

Some of you like to see my guesses. I’m guessing at an operating budget of about $132 million, State Aid of about $45 million, local receipts (fees, hotel & meals tax, excise tax, reimbursements, etc…) of about $15.5 million, and property taxes of about $77.5 million (about a $3 million increase). As mentioned above, the use of Free Cash or Stabilization to balance the operating budget or reduce taxes is not a good idea when we are so close to the Levy Ceiling. I hope the Mayor and City Council will take appropriate actions.

Thank you for reading all of this. If anyone has any questions or concerns, feel free to reach out to me at [email protected]

I hope you all had a great holiday weekend, and showed your respect and thanks to all of our service men and women, and their families, on Memorial Day.

Dave Flaherty

Westfield City Councilor

[email protected]