To the Editor,

Over my five terms on City Council I have reviewed every annual budget, and have had significant issues with most of them. This year is no different. The Mayor submitted the proposed budget to the City Council less than two weeks ago. The Mayor’s reasoning for the delay was that he wanted to wait until he had a better handle on union negotiations before submitting a budget. Is it just me, or does anyone else think this is a backwards process? Should the labor unions be telling us how much money we can spend on roads?

The Mayor and financial team should have a long-term forward-thinking budget plan, and then give the budgets to the various departments. Let the department heads and managing boards or commissions figure out how best to work within the budget. Or course there has to be some back-and-forth, and at certain times there need to be changes in plan, but the process should be top-down – not bottom-up. The Mayor and financial team understand the broader financial needs and challenges of the city. Whereas, the department heads and union leadership are only focused on their section of the budget. Rightfully, every department head thinks their department and needs are important. It’s very rare to have a department head say “I don’t need that much money, you can use it for another purpose”. Often, they have a list of “very important” needs that have to be met. Often they behave in protectionist mode instead of looking for ways to do things in a more efficient way across the city. This is the reality. The Mayor and the financial team – including the City Council who has to approve the budgets – have to take all these things into consideration and make the best choices for the city given the various demands and constraints.

The taxpayers are the ultimate customers and the ones who pay the bills. Their input is critical, and their demands should be respected. For the last ten years or so, the NUMBER ONE demand has been for better ROADS. Number two is to control tax increases.

I’m often asked about running for Mayor, or what would I do if I was Mayor. First, I can’t run for Mayor right now. I own a small business, and I can’t leave it for a two-year Mayoral term and then hope to hop back into it as I work towards retirement. Second, the Mayor is grossly underpaid for the job scope and impact. He or she manages a budget of over $150 million and over 1000 employees. He or she sets and ultimately manages the budgets for every department in the city, appoints department heads, appoints boards and commissioners, chairs the School Committee, and is on the receiving end of every complaint in the city. He or she deserves to be paid for the job scope and impact. This job is easily comparable to a CEO of CFO of a mid-size public company. Some people think that it’s “public service” and that a Mayor shouldn’t be paid well. To me that says “we don’t respect the Mayor’s role” and “we’re ok only attracting people who are willing to take that salary”. Neither opinion makes the job attractive for me or many other qualified people. Another way to look at the salary is by comparing it to other leadership salaries in the city (or in comparable cities). Right now there are over 75 employees in the City who make more than the Mayor. Would you think it’s fair to have a department head who manages 3 employees earn the same amount as the Mayor? Or, how about three layers of management in the Schools, Fire, and Police departments all earning more than the Mayor? How’s that make sense when the Mayor oversees all of those operations?

So, what would I do as Mayor? First, I’d start by making sure every taxpayer, department head, and employee understands all of the demands and challenges faced by the City. Then, I’d work with the financial team and key department heads to prepare a multi-year budget that addresses the needs and challenges. And, then I’d make sure to appoint department heads, and boards and commissions, who are willing to do what it takes to manage the budget for the betterment of the City.

I always prepare a multi-year budget after receiving the Mayor’s annual proposed budget. For years I’ve been saying the math looks really bad, and that we can’t keep going on the track we’re on. As you read in my article last month, we are still on a collision path with the Levy Ceiling (the maximum we can tax). This is not good.

I always prepare a multi-year budget after receiving the Mayor’s annual proposed budget. For years I’ve been saying the math looks really bad, and that we can’t keep going on the track we’re on. As you read in my article last month, we are still on a collision path with the Levy Ceiling (the maximum we can tax). This is not good.

So, how do we address that? I’ve prepared a five-year forward looking budget summary that delays the collision with the Levy Ceiling, increases funding for roads, and that starts seriously addressing the long- term health care obligation.

This rough plan has something for everyone to hate. I get it. Employees won’t like the way the wage increases look or the potential increases in health care contributions. People will want more spent on roads and infrastructure. Departments will say they can’t possibly manage on such a tight budget. Taxpayers won’t like to see the tax increases. The financial guys will say some of the estimates are a bit optimistic or pessimistic. Yup, all of that is true. However, this is fair, and it’s a good starting point for discussions.

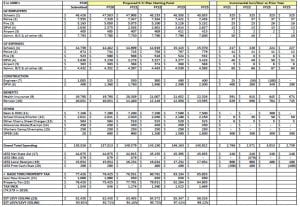

Please take a look at the attached spreadsheet. The top section summarizes the expenses. The bottom shows the expected revenues and taxes. The right section shows the changes from one year to the next. For each line item, I’ve included some discussion notes below.

For those who think some of the estimates are off, I agree, but we have to start somewhere. If we have extra money one year, we can stash it away, or use some of it for one-time special needs. If we come up short one year, we can use a little bit of money from our reserve accounts. The goal is to have a plan, and then to use it as a long-term guide. Annual tweaks are to be expected.

For those who want to see more spending in one area or another, take a look at the other expenses and the bottom line. There isn’t much wiggle room. We are quickly approaching the tax limit, and all of those other expenses are just as important to other departments or concerned citizens.

For those departments that are not listed, they’re included in the “Admin” line. My plan would be for the Mayor and his team to work within those numbers and be given the flexibility to move some things around as needed for particular years, and to look at ways of combining services or improving efficiencies. Flexibility is going to be very important moving forward.

Here are some notes about the line items:

(1) SCHOOLS – this budget shows the labor and expense line items separately. The City Council only approves one lump sum of money each year. The School Committee and Superintendent decide how to spend the money. This is a tight budget for everyone – schools included. Schools can no longer expect to take larger and larger shares of the budget. They have to work as a team with all of the other departments in the City and manage their budget in a way that lives within the financial constraints of the City. New school building funding may require a Debt Exclusion override vote due to existing budget obligations and constraints. I’d also propose a school stabilization account that would allow the schools to carryover money between years if that situation arises. The budget assumes that the state funding is moderate and that student population settles out. If state school funding or grant revenue increases, those funds would go to the school department or their stabilization account (in a way that satisfies the funding source).

(2) POLICE – this budget is tight. It assumes that new leadership will not be paid as much as outgoing long-experienced leaders, and that there are some steps taken to further control total labor costs. On the expense side, the budget tries to fund most of the cruisers every year. However, 2 or 3 will be funded using the towing and storage account or free cash.

(3) FIRE – this budget is tight. It assumes that new leadership will not be paid as much as outgoing long-experienced leaders, and that there are some steps taken to further control total labor costs. On the expense side, this budget funds vehicles in the same way. It also assumes that a good portion of future ambulance revenue will be allocated to future vehicles or capital improvements.

(4) DPW – this budget is tight. It assumes that new leadership will not be paid as much as outgoing long-experienced leaders, and that there are some steps taken to further control total labor costs. One the expense side, the road construction expenses have been pulled out in order to make them clear to everyone. This DPW category includes all of the DPW departments except for Water, Sewer, Sewer Treatment, and Stormwater.

(5) AIRPORT – the budget keeps things even, but the goal is still to have the Airport increase revenue enough to cover most of the normal operating costs. Assumptions for that income are included in the “Local Receipts” line item. Increases in Local Receipts are critical to making this budget work, and the Airport needs to play their part.

(6) ADMIN – this line item includes all administrative, legislative, and operational departments not listed separately. I’m assuming that eventually the Mayor will be paid more, a CFO will be added, boards and commissions will take on a larger role and will see adjustments in their compensation, and that departments and associated services will be tweaked to improve efficiencies and costs.

(7) ENGINEER CONSTRUCTION – I get that there are lots of projects in the pipeline,but we only have so much money. The people want their roads and other infrastructure maintained before adding new infrastructure and obligations. This 5-year plan should give the department the advance time it needs to manage future engineering planning costs.

(8) DPW CONSTRUCTION – this line item increases over time. It’s still not enough to make everyone happy, and doesn’t come close to the $5 million per year that is needed, but it’s a big step in the right direction. Chapter 90 (State Aid for Roads) is expected to be in addition to these funds – not part of these funds.

(9) HEALTH INSURANCE – the big elephant in the room. This line item includes the costs from the City Budget and the chargebacks from the State Aid Cherry Sheet. The forward looking budgets assume that the expenses are controlled and that employee contributions increase. Even with these optimistic assumptions, you can see that this expense is growing at a significant pace. Any “premium holiday” money would be deposited into the OPEB liability fund and not used in the general operating budget.

(10) PENSIONS – this budget keeps the current PERAC funding plan in place. This is the second big elephant in the room. The PERAC schedule assumes that the city will pay 5.8% more each year going forward in order to fully fund the pension plan by the early 2030’s. Hopefully with the current investment performance, the pension board and PERAC may be able to back off this 5.8% compounded burden. However, I’m not optimistic given the past performance and past accuracy in estimates.

(11) DEBT & RDD – this line item includes short and long-term debt payments, interest, and returns the Reserve for Debt Decline procedure. Any budgeted funds that are not needed in the budget year will be reserved for the future. This allows us to build up reserves, and by having this in the plan, we conserve enough budget space to handle projected future capital needs (with the exception of a giant project such as a school which may require a Debt Exclusion vote).

(12) SCHOOL CHOICE – this is how much money we spend sending kids to School Choice or Charter Schools. I’m hoping this is high, but it all depends on how many kids take advantage of these options. The School Committee and Superintendent are looking at ways of keeping more of these students in our system. There is a chance that the state could change the funding or reimbursements somehow, but nobody knows for sure. Public pressure is increasing.

(13) OTHER CHERRY SHEET CHARGES – this includes miscellaneous state charge, PVTA, etc… The budget shows modest increases.

(14) ALLOWANCE FOR ABATEMENTS AND EXEMPTIONS – this is a reserve account to cover property tax abatements and exemptions. $450K is typical for Westfield. If more or less is needed, the variances can be handled with Free Cash or “reserve for undefined” accounts.

(15) WORKERS COMP & UNEMPLOYMENT – this is a reserve account to cover workers comp and unemployment claims. $250K is typical for Westfield. Various labor agreements have different limitations on claims in this category. If more or less is needed, the variances can be handled with Free Cash or “reserve for undefined” accounts.

(16) OPEB – this is the reserve account to pay for retiree healthcare obligations. With current assumptions about health care costs, cost share, coverages, and life spans, the City owes employees over $240 million net present value. To cover this, we need to invest $9-$18 million per year every year going forward. As you can see looking at this budget, that’s impossible. Dramatic changes in the long-term healthcare plans are needed. This 5-year plan starts a path of funding, and gets the annual allocation up to a bit more than 2% of wages. More is definitely needed, but this is a good start.

(17) NET STATE AID – this is what we get from State Aid in Chapter 70 (Schools) and general funds (lottery and rare special funds) less a couple of earmarks. It does not include Chapter 90 (roads). The forward looking budget assumes modest increases. However, there are no guarantees with the state. Public pressure is on to improve the school funding formula, so maybe we’ll see improvements in the new future. Sin taxes should be increasing, so we should see some benefit from Marijuana and Gambling.

(18) SCHOOL BUILDING AUTHORITY – this is state reimbursement for old school work. This reimbursement will stop after FY21. NOTE: this money has been flowing into the city’s general fund – not earmarked for school department or debt repayment. The loss will have to be covered with other revenue or budget cuts.

(19) LOCAL RECEIPTS – this includes all the local fees, vehicle excise taxes, meals tax, hotel tax, marijuana tax, fines, reimbursements, airport fees, etc… In this budget, I’ve assumed that the City will see increases due to Airport operations, new revenue from marijuana sales, and increased ILOT payments from G&E.

(20) FREE CASH AND STABILIZATION – these are the two primary “savings” accounts for the City. My goals would be to only use them in an emergency, for special one-time expenses, or to buffer transitions between budget year ups-and-downs. We should not be counting on them to pay for recurring growing operating expenses. $200K in FY20 is to help increase road funding. $400K in FY22 and FY23 is to help buffer the loss of $879K in the SBA reimbursement.

(21) NEW GROWTH – this is the additional tax revenue associated with new development or property upgrades. It’s essentially the value of the new property times the previous year’s tax rate. So, if someone builds a million dollar property, and the tax rate is $38/$1000, the new growth would be $38,000. When the Levy Limit reaches the Levy Ceiling, the maximum rate is $25/$1000. The $850K estimates could be plus or minus several hundred thousand dollars. Extra revenue could reduce the tax burden, fund a reserve account, pay for a special one-time capital expense, or be used to pay-down a debt or obligation. A one-time variance should not be used to pay recurring growing operating expenses.

(22) PROPERTY TAX – after all of the expenses and incomes are considered, this is what’s left to pay by taxpayers. It’s growing. There is no way around this right now. As you can see from the budget, finances are a challenge. I’d certainly like lower taxes, but it’s not likely give all of the requirements, obligations, expectations, and other sources of revenue. As discussed above, the budget already includes some optimistic projections.

(23) ESTIMATED LEVY CEILING – This is a GUESS at what the maximum property tax can be given the estimated total values of property in the City. This is really hard to guess, but these numbers are certainly within the realm of reason. If property values are less than this, the city will not be able to tax as much. In order to balance the budget, the City will likely have to make unpopular dramatic budget changes. If the values are higher, the City has more wiggle room, but the taxpayers are already stretched and they do not want to see higher property taxes.

In conclusion, this certainly isn’t a perfect plan, and as I said above, there is something for everyone to hate. However, it is fair and realistic, and it’s a good starting point for discussions. We cannot continue on the current path.

The City Council is holding a public hearing on the FY20 City Budget Tuesday evening at 6PM in City Hall. Please review the budget online at https://www.cityofwestfield.org/727/Budgets-Studies, attend the Public Hearing, and express your opinions about the budget, expenses, and taxes. Your participation is critical.

I plan on suggesting about $1.5 million in budget cuts. This will not be popular. There will be great pressure from special interests saying that their favorite line-item cannot handle a reduction. Expect this, and expect a whole bunch of City Councilors to just go along with the budget without suggesting or supporting any cuts. They need your encouragement to get the results you expect. NOTE: “cut” does not necessarily imply that an expense is less than last year – it means that it’s less than the department asked for this year.

This budget drives your tax rates that will be set later in the year. As of right now, spending is up over $3 million and there is a 2.5% tax increase in the budget.

If you have any questions or concerns about anything covered in this article, or about the budget process, please feel free to reach out to me at any time.

Regards,

Dave Flaherty

City Councilor

[email protected]