Dozens of senior citizens attended the EASE program to learn how to deal with scammers. (Photo by Peter Currier)

WESTFIELD- The Office of the District Attorney of Hampden County and the Polish National Credit Union (PNCU) hosted an information session Tuesday evening at the senior center to help Westfield’s senior citizens avoid being the victims of modern scams.

The Educating Against Senior Exploitation (EASE) program was designed to help senior citizens identify and avoid scams meant to compromise their finances. Dozens of senior citizens attended the event in the senior center, hosted by Westfield’s Council on Aging.

Tina Gorman, executive director of the Council on Aging, said that she sees the scamming of the elderly as an enormous problem in Westfield and beyond. She noted that she had been approached by the Polish National Credit Union (PNCU) about doing a presentation such as this.

“I get emails from the Executive Office of Elder Affairs (EOEA) on a regular basis,” said Gorman, “at least once a week with the latest scam.”

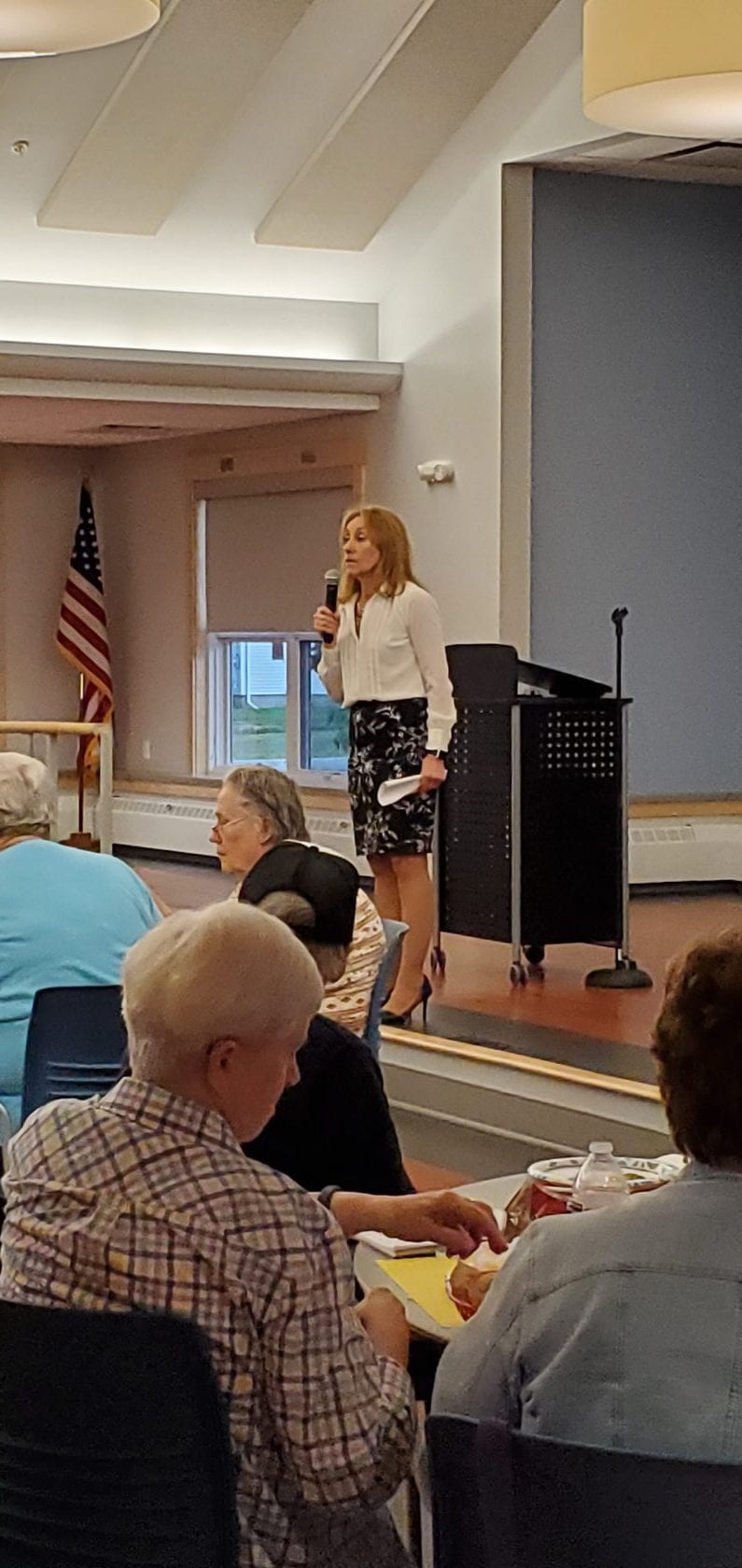

Assistant District Attorney Joan O’Brien gave a lot of advice on how to identify and avoid scams. (Photo by Peter Currier)

Assistant District Attorney Joan O’Brien gave the presentation.

One of O’Brien’s main points was that it is extremely difficult to prosecute the perpetrators of some of the common scams, as more often than not they are based outside of their jurisdiction. She added that in an average year, $3 billion is scammed from senior citizens.

“There are things we can’t do to help you. So, we want to be proactive and tell you what to do so you never fall victim to one of these scams.” Said O’Brien.

She warned that scammers will usually do things to try to gain a person’s trust. O’Brien recommended that if there is even a question of whether something is a scam, they should not act alone or in haste.

She told the story of a woman from a previous presentation who said that she had almost fallen for a scam once.

The woman received a call with a caller ID from her own bank. A friendly man on the other end of the phone said there were some problems with her account. He said she needed to verify some information to get account access to her account again. The man listed off her name, age, address, and phone number to “verify” that it was her.

Finally, he read off a social security number that was remarkably close to her real one, and she instinctively corrected him with the right number. After getting off the phone, the woman realized that she may have been scammed. She then called the bank, who verified that nobody called her, so they put a freeze on her account.

O’Brien also listed some classic scams that have been circulating in the area as of late. Someone will call claiming to be a grandchild in distress. They will say they are in trouble or in jail and need significant amounts of money to get out of it.

Another scam circulating is the classic grandparent scam. The person will call claiming to be the victim’s distressed grandchild who is in trouble or in jail. They will say they need a lot of money to get out of whatever situation they are in. Usually, the money will be asked to be sent to a specific address via mail and via cash.

Another new scam involves people calling the victim claiming they are from the government. They will claim that your social security number has been used in a crime and that your accounts have been frozen. In this case, however, they will list off your actual social security number. They likely acquired the number following large data breaches such as the Equifax breach in which millions of social security numbers were exposed.

The person will then say that they need you to pay money to unfreeze the account, usually via wire transfer, or in some cases, gift cards.

Another notable scam that doesn’t necessarily target the elderly is the callback scam. Somebody will call with some fake excuse, and eventually they will ask for you to call them back at a different number. When one calls that number, their phone account will be charged a large toll that will not be disclosed to you before you call, unknowingly giving money for every minute you are on the phone.

O’Brien’s advice to avoid the scams is pretty simple, when in doubt, don’t even pick up the phone. If it is a legitimate call, the caller should leave a message. Also, if there is a suspicious link in an email, just don’t click on it.

“Even if you have caller ID, sometimes it will come up looking legitimate.” Said Gorman, “I have had people who won’t answer the phone when they see ‘City of Westfield’ when I make the call because they’ve had other cases where it wasn’t the City of Westfield when they answered the phone.”

Gorman noted that while many of the scams towards the elderly are conducted by “professional” scam artists, a lot of scams are conducted by a member of the victim’s family.

“A lot of the time there are underlying problems. It might be an addiction problem, it might be drugs, alcohol, or a gambling addiction,” said Gorman, “A few years ago we had a woman who came in and her grandson had wiped out her bank account… of course, this was somebody she loved. This was not a guy who was typically in trouble or anything. She had nothing.”

Peter Currier can be reached at [email protected].